property tax calculator frisco tx

Pin By Business Directory On Minnesota Nature Garland Tx Beauty Services Financial Services. Enter your Over 65 freeze year.

Conroe Proposes Raising Property Tax Rates Ahead Of Next Year S State Mandated Cap Community Impact

It is the duty of the Tax Assessor-Collector to assess and collect for the County all taxes imposed on property within the county.

. Property tax calculator frisco tx Monday February 28 2022 Edit. Sales Tax State Local Sales Tax on Food. The Collin County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Collin County and may establish the amount of tax due on that property based on the fair market value appraisal.

Youll pay only when theres a tax. School Board Drops Tax Rate for Third Straight Year Frisco Property Taxes Frisco Rmends Raising Property Taxes Texas Scorecard Frisco property tax rate to remain unchanged for 2020 PISD adopts same tax rate for fifth year in a row Plano Star. Frisco Property Taxes City of Frisco Raised Taxes 38 Percent Over Last Five Years.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. This home was built in 2020 and last sold on 142021 for 400000. 2007 Exemptions and Property Tax Rates.

Frisco texas and little elm texas change places. Enter the value of your property. Over 65 65th birthday 30000.

Enter the Address Here. Enter your Over 65 freeze amount. Please select your school.

Ad Search Property Tax Records from Home Without Lines or Paperwork. Please choose your exemption. For more information call 469.

Youll pay only when theres a tax decrease when you join with protest firms on a contingent fee basis. Enter your Over 65 freeze amount. Please select your city.

The tax rates are stated at a rate per 100 of assessed value. This calculator factors in PMI Private Mortgage Insurance for loans where less than 20. Please select your city.

Our Texas Property Tax Calculator can estimate. Property tax calculator frisco tx. Property Tax Calculator Frisco Rmends Raising Property Taxes Texas Scorecard Frisco Property Taxes PISD adopts same tax rate for fifth year in a row Plano Star Courier starlocalmedia School Board Drops Tax Rate for Third Straight Year Frisco property tax rate to remain unchanged for 2020 What Is The Property Tax Rate Frisco Heres a new.

1 from Denton County which will include Lewisville ISD and 1 from Collin County which will bill for the City of Frisco taxes due. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States. For more information call 469.

Enter the value of your property. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and. Pay property taxes on time.

Please select your county. Enter your Over 65 freeze year. To avoid penalties pay your taxes by January 31 2022.

Enter the value of your property. Groceries are exempt from the Frisco and Texas state sales taxes. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

This calculator factors in PMI Private Mortgage Insurance for loans where less than 20 is put as a down payment. Property tax in texas is a locally assessed and locally administered tax. There is no state property taxProperty tax brings in the most money of all taxes available to local governments to pay for schools roads police and firemen emergency response services libraries parks and other services provided by local governments.

The property tax is used to finance the states 254 counties over 1200 cities 1022 independent school districts and more than 1800 special districts. Taxing units set their tax rates in August and September. How to Get Your Taxes Reduced for Free.

This type of an agreement means the cost you pay is restricted to a percentage of any tax. The Collin County tax bill now includes Collin County City of Frisco Frisco ISD and Collin County Community College district taxes. 2022 Cost of Living Calculator for Taxes.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The Frisco Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Frisco local sales taxesThe local sales tax consists of a 200 city sales tax. Leander Texas and Frisco Texas.

Property tax in texas is a locally assessed and locally administered tax. Frisco Property Taxes City of Frisco Raised Taxes 38 Percent Over Last Five Years. Those property owners living in Denton County will still receive 2 statements.

Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar. The Frisco Sales Tax is collected by the merchant on all qualifying sales made within Frisco. Real property tax on median home.

Frisco texas and little elm texas change places. Property tax calculator frisco tx Monday February 28 2022 Edit. Property tax in Texas is a locally assessed and locally administered tax.

15910 Trail Glen Dr Frisco TX 75035-1651 is a single-family home listed for-sale at 495000. At this point property owners usually order service of one of the best property tax attorneys in Frisco TX. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth.

Collin County Assessors Office Services. This mortgage calculator can be used to figure out monthly payments of a home mortgage loan based on the homes sale price the term of the loan desired buyers down payment percentage and the loans interest rate. View the Full Range of County Assessor Records on Any Local Property.

Property Tax Statements are mailed out in October and are due upon receipt.

Tarrant County Tx Property Tax Calculator Smartasset

Budget And Tax Facts City Of Lewisville Tx

Tarrant County Tx Property Tax Calculator Smartasset

Where Are Lowest Property Taxes In North Texas

Which Texas Mega City Has Adopted The Highest Property Tax Rate

What Is The Property Tax Rate In Frisco Texas

Budget And Tax Facts City Of Lewisville Tx

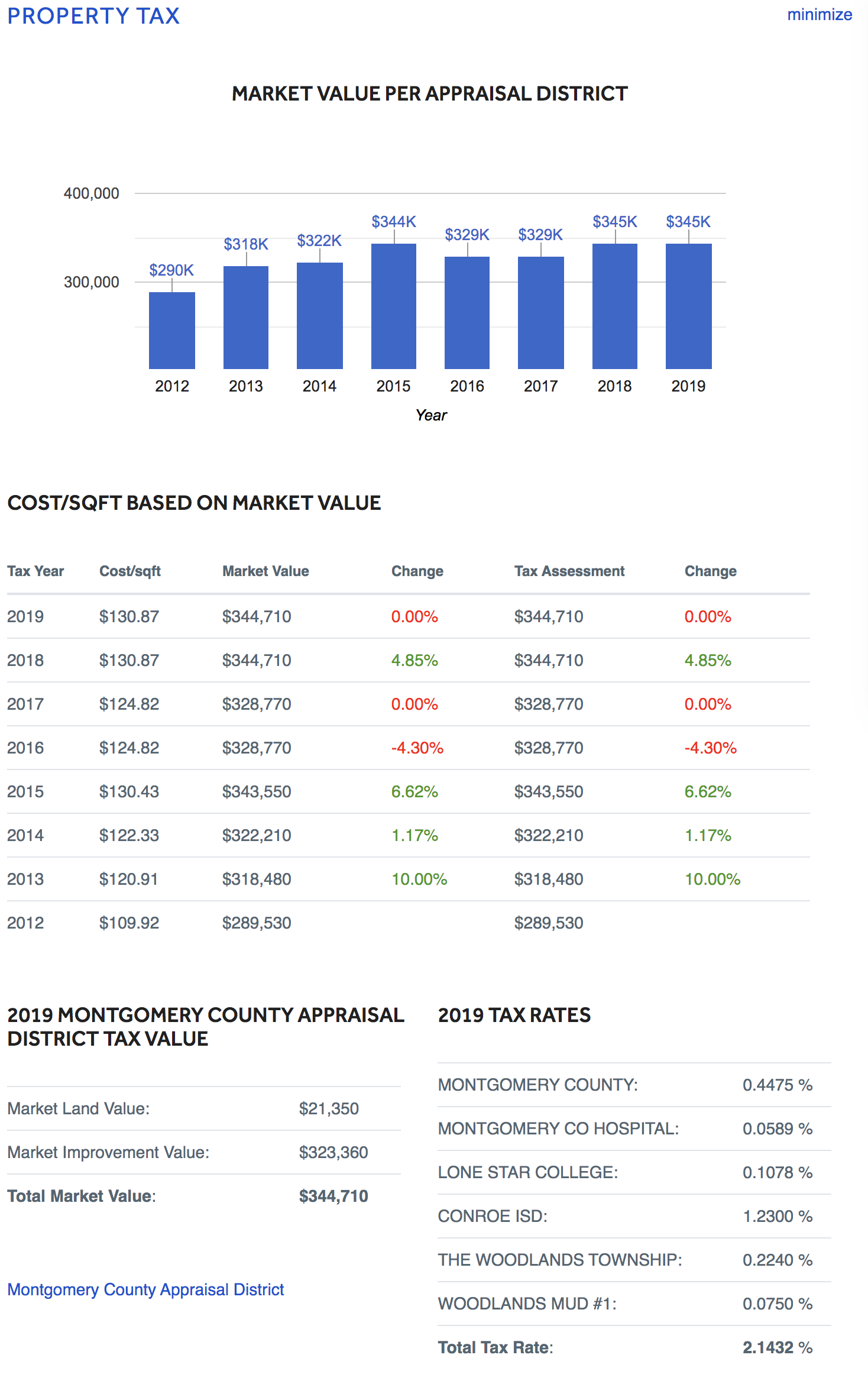

New Construction Neighborhoods With Low Taxes In Montgomery County Har Com

Taxes Celina Tx Life Connected

What Is The Property Tax Rate In Frisco Texas

5 Tax Deductions When Selling A Home Selling House Tax Deductions Selling Your House

Why Are Texas Property Taxes So High Home Tax Solutions